CivicRisk Mutual is member-owned and operated, a fact that is reflected in everything we do. From our humble beginnings in 1988 to today, we’ve remained committed to protecting and serving our members — whom we owe all our success.

But before we became who we are today, there were six courageous Councils from Western Sydney that came together with a shared vision: taking control of risks and creating safer communities.

Our History at a Glance

It was 1988, and there was an insurance crisis that left Councils vulnerable to the effects of an increasingly costly and unpredictable environment. In response, the six founding members decided to create a self-insured pool for public liability and the Mutual was born.

The first 12 years of pooling were challenging as Councils continued to manage the ever-increasing cost of liability claims and litigious environment that favoured plaintiffs at the expense of local government. But in 2002, after years of lobbying and providing evidence that indicated a clear need for change, the unbalanced legal system caused the State Government to introduce the Civil Liability Act — which provided a more favourable legal system with sound defences, placing personal responsibility on claimants.

Then, our founding members continued to work closely with the government and collaborated to develop more effective laws. Identifying the unique needs of local government, they succeeded at creating a suite of protection program products including:

Westpool is created to provide Public Liability and Professional Indemnity insurance for Western Sydney Councils.

Our six founding member Councils:

- Blacktown

- Blue Mountains

- Fairfield

- Hawksbury

- Liverpool

- Penrith

decide to pool their risks to manage the ever-increasing cost of liability claims and a litigious environment that heavily favours plaintiffs at the expense of local government.

Metro Pool is established to provide Public Liability and Professional Indemnity insurance for Sydney Metropolitan Councils:

- Auburn City

- City of Botany Bay

- City of Holroyd

- Hunters Hill

- Lane Cove

- Marrickville

- Rockdale

Joint Pools obtain Public Liability and Professional Indemnity protection through the London market.

HIH Insurance collapses, causing large premium increases. Joint Pools buy “ground up” cover in a three-year deal.

City of Parramatta Council joins Westpool.

The Civil Liability Act is introduced.

Westpool and Metro Pool agree to share services and management, creating a centralised single service team of providers. They also investigate new products for the local government.

United Independent Pools (UIP) is established to provide Corporate Travel, Councillors, Directors and Officers (CDO), Personal Accident and Property protection.

Motor Vehicle protection is established.

Global Financial Crisis causes a downturn in investments.

Continuous Risk Improvement Program (CRIP) established along with funding grants for Risk Enhance projects, motor vehicle driver safety training and Study Assistance.

Wollongong City Council joins Westpool.

Statutory Liability cover is included in CD&O.

Kiama Municipal Council joins Metro Pool.

Shellharbour City Council joins Westpool.

Community Support, Crime, Marine Transit and Statutory Liability protection is established.

Burwood Council joins Metro Pool.

Employment Practice Liability protection is established and combined with CDO and Statutory Liability as

Management Liability.

Camden Council joins Westpool.

Mutual Management Services Limited (MMS) is established.

Cyber Liability protection is established.

Council amalgamations.

UIP is renamed to CivicRisk Mutual, Westpool is renamed to CivicRisk West and Metro Pool is renamed to CivicRisk Metro.

MMS granted AFS Licence.

The Western Sydney Regional Organisation of Councils (WSROC) joins MMS.

Orange City Council joins CivicRisk West.

Dubbo Regional and Wollondilly Shire Councils join CivicRisk West.

MMS is renamed to CivicRisk Mutual Limited.

CivicRisk Mutual, CivicRisk West and CivicRisk Metro merge into a single entity — CivicRisk Mutual Limited — to better meet compliance obligations, service our growing membership base and position ourselves in the protection program market by taking advantage of our collective strength.

Many years of member’s decisions has led to the creation of a healthy reserve, which has protected members during hard times and enabled a return of $10 million surplus to members.

The Mutual’s constitution and member rules are designed to govern CivicRisk Mutual Limited with the overarching goal of transparency and members customising their own experience.

Six new councils join CivicRisk Mutual Limited:

- Gunnedah Shire

- Mid-Western Regional

- Parkes Shire

- Richmond Valley

- Snowy Monaro Regional

- Willoughby City

Dedicated member liaison and risk management support is established.

CivicRisk Mutual Limited establishes CivicRisk Insurance Limited in Guernsey, a wholly owned insurance captive to access reinsurance markets and reduce insurance costs — saving $2.7 million against budget expectations.

New member portal launched demonstrating continuous commitment to improving member services.

Moira Shire and Port Macquarie Hastings Councils join CivicRisk Mutual Limited.

Funding grant program increased by 35% to offer members greater support with implementing CRIP recommendations, Risk Enhance projects, motor vehicle driver safety training, risk management software and reporting tools.

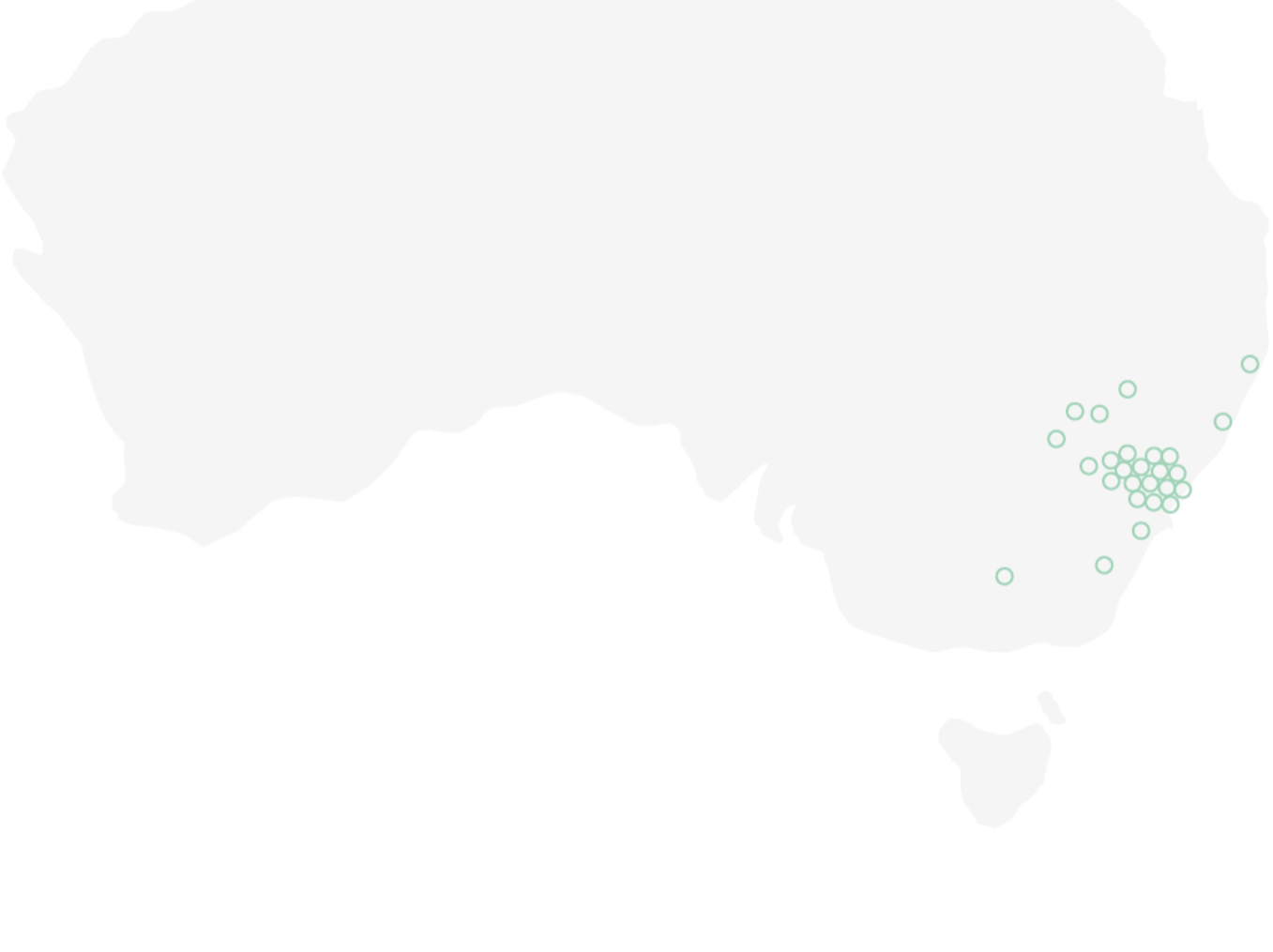

Hobsons Bay City Council joins CivicRisk Mutual, bringing the total membership to 27 councils and 1 Regional Organisation.

Join other like-minded councils in building safer, more resilient communities.

Our Business

It’s been over three decades since the Mutual was established and, in that time, we have experienced tremendous growth and success as a direct result of our fidelity to the principles of mutuality — we’ve welcomed 26 Councils located throughout NSW and Victoria into our membership, achieved $95 million in savings and provided risk management support in the form of protection, services and benefits.

To ensure our operations run smoothly, we have a dedicated team who are responsible for all Council administration and compliance. Our members can also access our Member Portal, which contains a wealth of useful information, including document templates, training session recordings, information about the Mutual and more.

As far as funding goes, our members pay into the Mutual with an annual contribution calculated with a combination of statistics relating to the Council’s size and claims history. These contributions are used for the following purposes:

- Self-insured retention.

- Group Policy Insurance Premiums.

- Risk management support.

- Claims management and broker services.

- Administrative expenses.

- Prudential margin.

- Professional development and training.

Most importantly, our business is based on collaboration and cooperation — we share resources and information, and support each other in order to fulfil our mission.

Join CivicRisk Mutual

As we look to the future, we remain committed to our core principles and will continue to deliver on a promise of excellence in service. It’s our belief that by working together as one, we can build a better tomorrow for all Australians.